Blog # 213 I talked about Rule number one don’t ask what you’re eating. In this blog I want to talk about INC 500 and some new faces.

INC 500

October issue of INC 500 Zappos is ranked #15 in fastest growing private companies. Tony sends out an e-mail to everyone to make sure we all knew. It was a simple e-mail that just said “We made the INC 500 fastest growing private companies list ranked at #15”

Funding Press release

The following release went out to the public in October:

ZAPPOS.COM SECURES ADDITIONAL FUNDING TO SUPPORT ITS RAPID GROWTH AND BUILD ITS “SERVICE” BRAND

$20 Million Equity Funding From Sequoia Capital

$40 Million Credit Line From Wells Fargo Business Credit

LAS VEGAS, NV — October 28, 2004 — Zappos.com, Inc. announced today the closing of a $20 million round of equity funding from Sequoia Capital. Zappos.com also announced an increase of their revolving line of credit with Wells Fargo Business Credit to $40 million. The funds will be used to support the company’s rapid sales growth and to improve the customer experience. Zappos.com is expecting to surpass $175 million in gross merchandise sales this year.

Michael Moritz will be the active partner from Sequoia Capital and has joined the Zappos.com Board of Directors. “We were impressed with the focus that Zappos.com has on service and creating the best possible online shopping experience,” Moritz said. “They may sell just shoes and handbags today, but in the long term, the brand will be about the service, not about the shoes. We think there is an opportunity here to create a long-lasting, compelling consumer brand focused on service.”

Jeffrey Cristol will continue to be the active Relationship Manager from Wells Fargo Business Credit handling the Zappos.com account. “We have enjoyed working with Zappos.com for the past one and a half years,” Cristol said. “It has been exciting to watch their impressive growth and support them along the way.”

About Zappos.com

Zappos.com is an online retailer stocking over one million pairs of shoes and handbags with selections from more than 300 brand names. With a focus on service, the company has grown rapidly since its inception in 1999, with sales more than doubling year-over-year every year since it was founded. The company achieved $70 million in gross merchandise sales in 2003, and expects to achieve over $175 million in gross merchandise sales in 2004. For more information about Zappos.com, please visit www.zappos.com.

About Sequoia Capital

Since 1972, Sequoia Capital has provided startup venture capital for very smart people who want to turn ideas into companies. As the “Entrepreneurs Behind the Entrepreneurs”, Sequoia Capital’s Partners have worked with the entrepreneurs behind Cisco Systems, Yahoo!, Network Appliance, PayPal (eBay), Vitesse Semiconductor, Oracle, and Google to name a few.

More Good Press:

Zappos continues to get good press. Here’s some from a big online shopping forum:

Thought you might like to read the thread on your store from a BIG online shopping forum.

Date Posted: Oct/20/2004 12:44 PM

“Best return policy ever! You could trust them”

“thanks, I’ll check it out”

“I would give this place a 10 out of 10. They have GREAT prices…. extremely fast shipping. To date my best experience with internet shopping. You can’t lose with these guys”

“Agreed, a great online store. Wonderful all around”

“Zappos is great. Placed order, was upgraded Free to express shipping, and it shipped next day, so I got the shoes in 3 days! Returns are super easy too”

“Thanks everyone, you’ve inspired me to try them; I just placed an order”

“Without a doubt, the absolute BEST customer service of ANY online retailer I have ever bought from. (No, I’m not affiliated with them, but I’ve bought/returned/price adjusted/exchanged to get the perfect fit- quite a number of shoes/boots)”

“Nice Shoes”

First cost education grows

My First cost education was growing too.

This is what to expect on costing shoes out. the following is based on a 10.00 shoe:

- 10.00 shoe

- +duty (this varies on the material. 10.34% for leather,6% for vinyl +and 37% for fabric)

let’s use leather:

- 10.00 + 1.03=11.03

- +10% commission 11.03+1.00=12.03

- +freight (could be more or less depending on weight, pairs ordered, but

as an average .75 cents)

- 12.03+.75=12.78

- BWI (this is basically insurance that the factory has to take out

From going to the factory to the freight forwarder and costs basically .35

cents)

- 12.78+.35=13.13

- terms costs (if you asks for longer terms it cost the factory more so

we get charged more. Basically its 3% for every 30 days in terms

x-factory)

- 13.13+.60 (90 days x-factory)=13.73

If you land an item, they take the basic cost price and mark it up a

percentage. This percentage varies depending on the relationship you

have with the manufacturer. the difference besides the price is also ownership.

if you buy something landed you own the merchandise when it hits the US.

first cost, we own it when it gets to the freight forwarder.so if the

boat sinks or the merch gets wet first cost, it’s our problem.

So, let’s take the 10.00 shoe. with a good relationship we can expect

35%. so, you still pay the duty and freight and then add in the 35%,

the shoe lands somewhere around 16.30 depending on the terms you get.

Branded education too

We were turning some shoes extremely fast because we couldn’t buy enough due to credit constraints. Born was a great example of this. We were always out of stock in our best shoes. Problem was our credit line was small too. Every month we hit our credit limit. We were turning the inventory ten times. Usually 3.5 – 4 is a good healthy turn.

I worked with my rep Lori to get us more inventory and their credit department to give us more to play with. I remember talking to them in my garage for privacy and we landed a deal. We were only doing 30k a month at the time but once we got more inventory the next month it blew up to 300k. Today it is still one of our top brands.

New faces

Steve joins the company in November as an inventory analyst. He had interviewed with a bunch of us so we were expecting him to join at some point. I had worked previously with Steve in the Valley Fair Nordstrom floor. He was the Men’s Buyer at the time right before I left. We always had great conversations across the aisle.

Alfred joins the company later in December as CFO and Chairman. While at Harvard, Alfred metTony while running a student-owned pizza parlor at Harvard. Alfred was Tony’s best customer because he was buying whole pizzas, splitting them into slices, and selling them for a profit. Alfred joined Tony at Link Exchange as CFO. 18 months later Link Exchange sold to Microsoft for $265 million. With Tony, he also co-founded Venture Frogs, an incubator and investment firm. Venture Frogs invested in a variety of tech and Internet startups, including Ask Jeeves, OpenTable, Tellme Networks, and Zappos.

Zappos reaches a total headcount of 235 employees. I was traveling so much I didn’t know what time zone I was in half the time. Next week we would be going to NYC for the FFANY shoe show.

…just sharing my story and tips from my footwear career.

Subscribe to my Blog by filling out the info below and then press the “subscribe” button

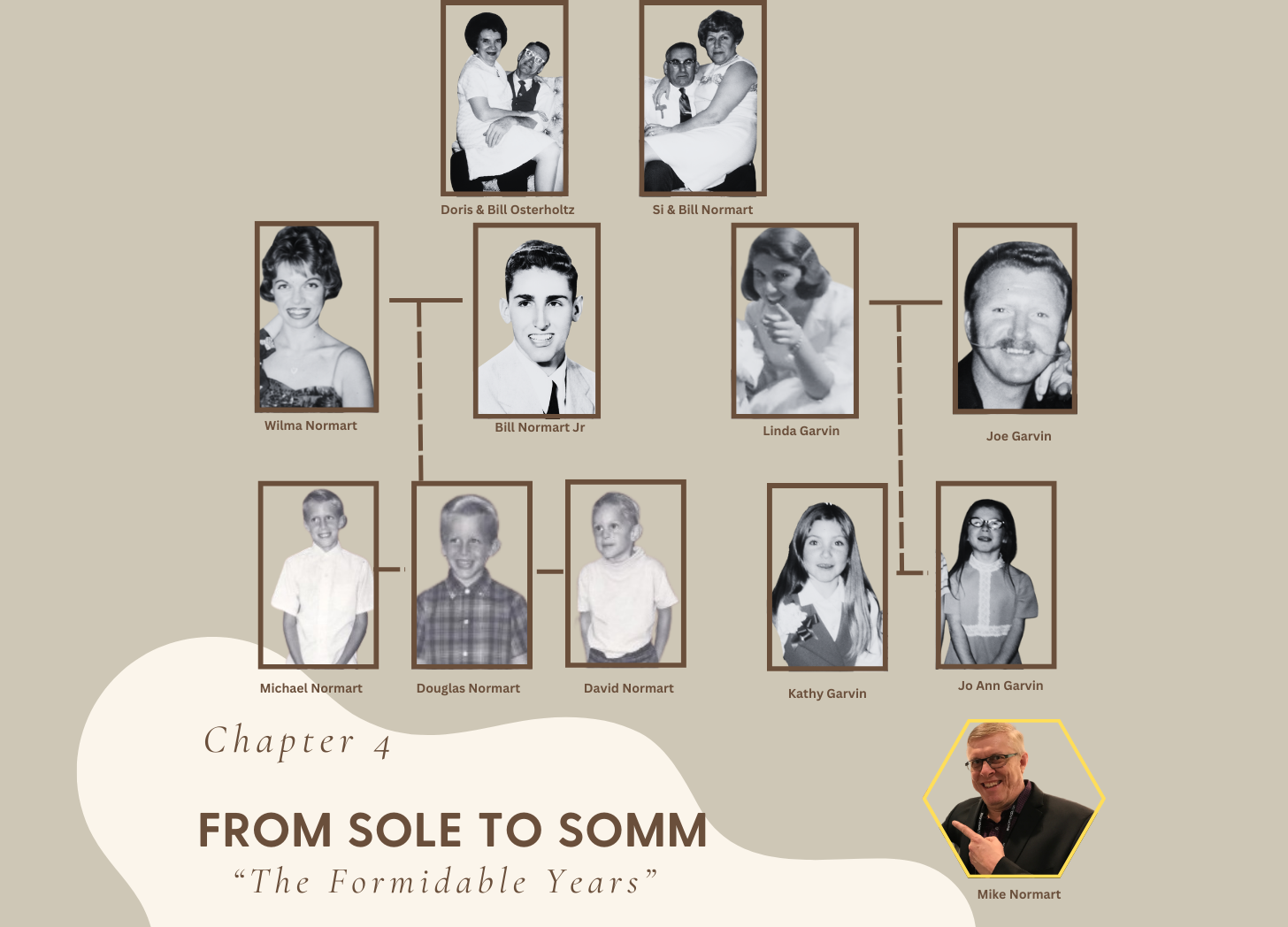

From Sole to Somm – My Brothers and 1st Cousins

From Sole to Somm – The Impressionable Years